Taxes:

Here's how taxpayers can resolve common after-tax day issues

Taxes -

While this year's deadline to file and pay federal income taxes has passed for most people. Here are some tips for taxpayers handling some of the most common after-tax-day issues.

Be ready to verify your identity when calling the IRS

Taxes -

It can take time to reach the right party at the IRS, so it's very important that you can verify your identity when you reach an IRS phone assistor. Make sure that you do not have to call back by being prepared.

You may be eligible for the Recovery Rebate Credit even if you don’t normally file a tax return

Taxes -

Filing electronically with tax preparation software, including IRS Free File, will help you figure the credit amount. Choosing direct deposit will net you an even faster refund.

Owe Taxes But Can't Pay?

Taxes -

Do you owe taxes but can't pay? You may be in luck. Here is a video tax tip from the IRS.

Gather records for the 2022 tax filing season

Taxes -

Before you start working on your taxes, it's important to get all your tax records ready. Filing an accurate tax return can help prevent processing and refund delays.

E-file and direct deposit help expedite tax refunds

Taxes -

E-file software helps you avoid mistakes by doing the math. It guides you through each section of your tax return using a question-and-answer format. This is important because the IRS recently incorporated changes to the tax laws into forms and instructions like the 1040 and 1040-SR.

How the expanded 2021 child tax credit can help your family

Taxes -

The American Rescue Plan Act expands the child tax credit for tax year 2021. The maximum credit amount has increased to $3,000 per qualifying child between ages 6 and 17 and $3,600 per qualifying child under age 6.

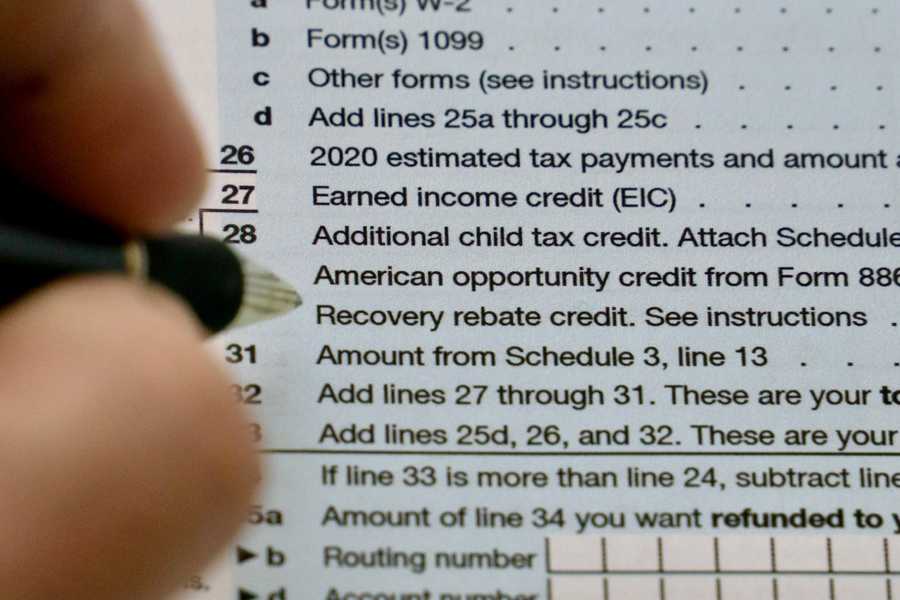

Check your Recovery Rebate Credit eligibility

Taxes -

People who are eligible for the Recovery Rebate Credit – and either didn't receive any Economic Impact Payments or received less than the full amounts – must file a 2020 tax return to claim a Recovery Rebate Credit, even if they don't usually file.

Become a tax volunteer and learn a vital skill

Taxes -

Volunteering can be educational, rewarding, and fun. Join the Volunteer Income Tax Assistance or Tax Counseling for the Elderly programs, and learn to prepare taxes for people in your community.

New employer credit available for paid family leave

Taxes -

Eligible employers can receive a refundable credit for required leave provided to employees who are unable to work or telework because they're caring for someone with COVID-19, caring for a child whose school or place of care is closed, or childcare is unavailable due to COVID-19.