Taxes:

New employer credit available for paid sick leave

Taxes -

Eligible employers can receive a refundable tax credit that reimburses them the cost of providing required paid sick leave to employees unable to work or telework. Employers are entitled to a sick leave credit of up to 80 hours, a maximum of $511 per day, but no more than $5,110 per employee in total, plus related health care costs.

If you’re self-employed, checking your tax situation just got easier

Taxes -

The Tax Withholding Estimator helps make it easier for everyone to pay the correct amount of tax each year.

This tool can help you tailor the amount of tax you have withheld from your income during the year and avoid surprises at tax time.

Retirees: New IRS tool makes it easier to check your withholding

Taxes -

This tool helps you tailor the amount of tax withheld from your income to target a tax due amount close to zero or a refund amount making it easier for retirees to pay the correct amount of tax.

What to do with your Tax Withholding Estimator results

Taxes -

The easiest way to make sure your employer is withholding the correct amount of tax from your paychecks is to do a Paycheck Checkup using the Withholding Estimator. Once you’ve completed a Paycheck Checkup, review the results and, if necessary, change the amount of tax your employer takes out of your paycheck.

Tips for using the IRS Tax Withholding Estimator

Taxes -

The IRS encourages everyone to use the Tax Withholding Estimator. It helps workers tailor the amount of income tax their employer should withhold from their paychecks and avoid unexpected results at tax time.

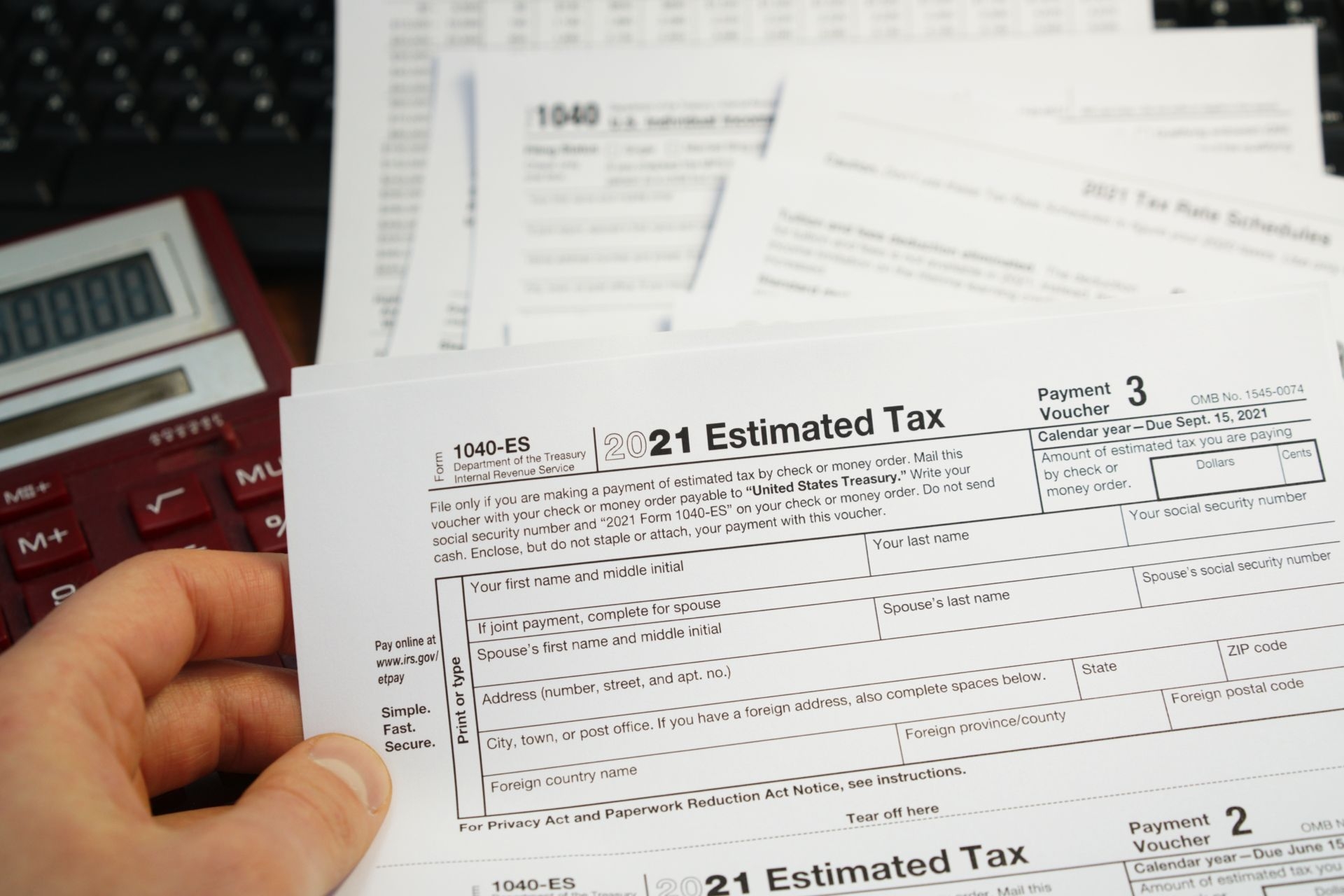

An estimated tax payment could help avoid a penalty

Taxes -

Under certain conditions, you may need to make estimated tax payments.

Employers: Consider benefits of filing payroll taxes electronically

Taxes -

There are distinct benefits of e-filing. If you are an employer, you should be considering how they could benefit you.

Is that the IRS contacting you – or is it a scam?

Taxes -

We've compiled some of the most common tax scams, including common phone call scams and email scams from thieves pretending to be from the IRS.

Things to think about when choosing a tax preparer

Taxes -

It’s the time of the year when you may be choosing a tax preparer. Choose wisely because you are responsible for all the information on your income tax return.

Taxpayers can get tax info on social media

Taxes -

Everyone is on social media these days, and I mean everyone. Even the IRS. If you'd like to follow us, here are our social media links and what we share on each network.